I didn’t write for many months, I will try to update my site more frequently.

I sold almost all my lines just before COVID-19 came to Europe. I went hardly short on February using 75% of my French portfolio on a double short ETF replicate (BX4). I anticipated this crisis using reddit and following reports of r/China_Flu so thanks Reddit (and a big shame to Twitter that censored all COVID hashtag from january to february).

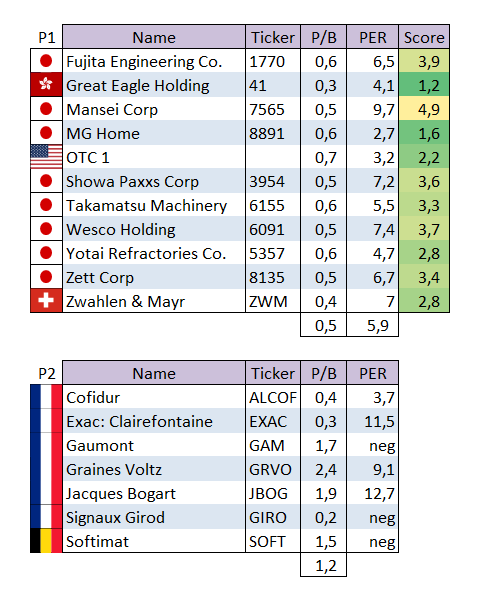

Here is my current portfolio :

- BX4 (leveraged x2 short CAC40 ETF) purchased at 3.02€

- Softimat purchased at 3.53€

- MG Home (analysis to come)

- Nisso Pronity (analysis to come)

I kept Softimat cause I have a big stake there and the stock is pretty illiquid + I think it won’t be as much impacted by COVID-19 cause of :

- It has few number of employees that still can work from home ;

- The society is a REIT, Real Estate is a protection from inflation if BCE print money as FED did ;

- Buybacks continue during crisis (last buybacks on March 26 at 4€).

The only risk would be renters to stop pay their lease cause of bankruptcy, I have to conceed I didn’t checked who are the renters.

I will post a more in depth analysis about Softimat soon.

Now is the biggest challenge : when to exit short. Well I don’t know, I think crisis is front of us and not behind. I read on a twitter account (such scientific haha) that CAC40 net value is 3200, I won’t go under this price and it feel a correct take profit. I still don’t have stop loss, I don’t like them, I bet I exit if people restart to work, and if I find good opportunities with a better risk reward than my short. Japan is the first step, I have some companies I’m waiting to invest on.