180 degree capital is a closed-end mutual fund discounting to his Net Asset Value.

Discount was 30% in December, now it’s 55% based on pre-crisis portfolio valuation. It could be lower or higher depending on the portfolio performance during crisis. I didn’t check evolution of all public portfolio lines but below is the evolution of two of them. What we can see is they weren’t that much impacted by the virus:

Some metrics (using $1.4/share) :

- NAV/Share = 3.06

- Price/Book = 0.45

- MarketCap = 40M

- ROE = 15%

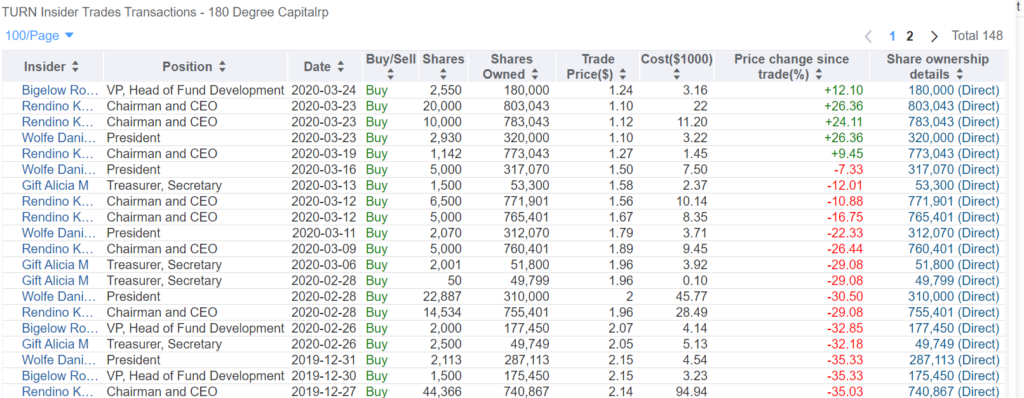

Insiders continued buying shares during crisis, none of them sold. They bought the bottom. A good sign telling me they are confident for the future.

Conclusion : A pretty decent discount, with insider buying and a decent manager focusing on micro cap activism. Impact of crisis is uncertain but the big discount protects us quite enough.

-> Long. Purchase price: $1.4.

Ah some fast news : I closed my short position and Softimat skyrocketed this week! Some purchases will come on next weeks. Cheers.