Gevelot is a French company operating in oil and gas industry. This company is profitable, it’s still growing and it’s incredibly cheap (share price trades under net cash). The growth rate was even better a couple of years ago but the company sold one of its bigger branches (Extrusion) in 2017 (explaining the last rally towards 220€/share).

Financial Ratios

- Market Cap (in EUR) = 117M€

- Net Cash = 160M€

- Price to Book = 0.58

- Price to Sales = 1.11

- EV/EBITDA = -2.1

- PER = 13.34

- Revenue growth = 10.3%

- Debt/Equity = 6.2

The company has a negative EV and is profitable. Net cash is way superior to market cap. Debt is very low. That’s all.

Chart

Share price was stuck during two years and then plunged from 200 to 140€ during the COVID-19 pandemic creating a big discount over cash. The company management has announced in the last annual report that 2020 results will be impacted by the pandemic but the net results should remain positive.

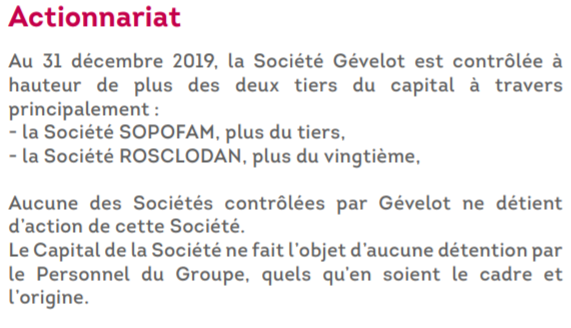

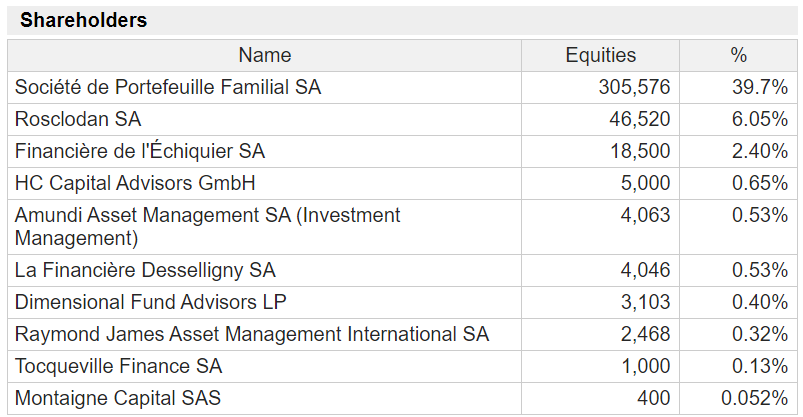

Shareholders

The company and its insiders don’t own any shares. More than 66% of the shares are controlled by SOPOFAM and ROSCLODAN and other societies.

Catalysts / Risks

- Possible catalyst: Takeover or Activism in order to take control of its net cash. The company could use its cash for acquisitions at a fair price like it did before.

- Risk: Cash burn if the global conjuncture keeps deteriorating (e.g. a second COVID-19 wave).

- Con: As my wife pointed out, it doesn’t seem an eco-friendly business.

Conclusion

The company is profitable and it’s quoting under net cash. The upside potential seems limited but we have a good margin of safety.

-> Bought at 149.8€.

My objective is 200€/share, which is still under Net cash/Share.

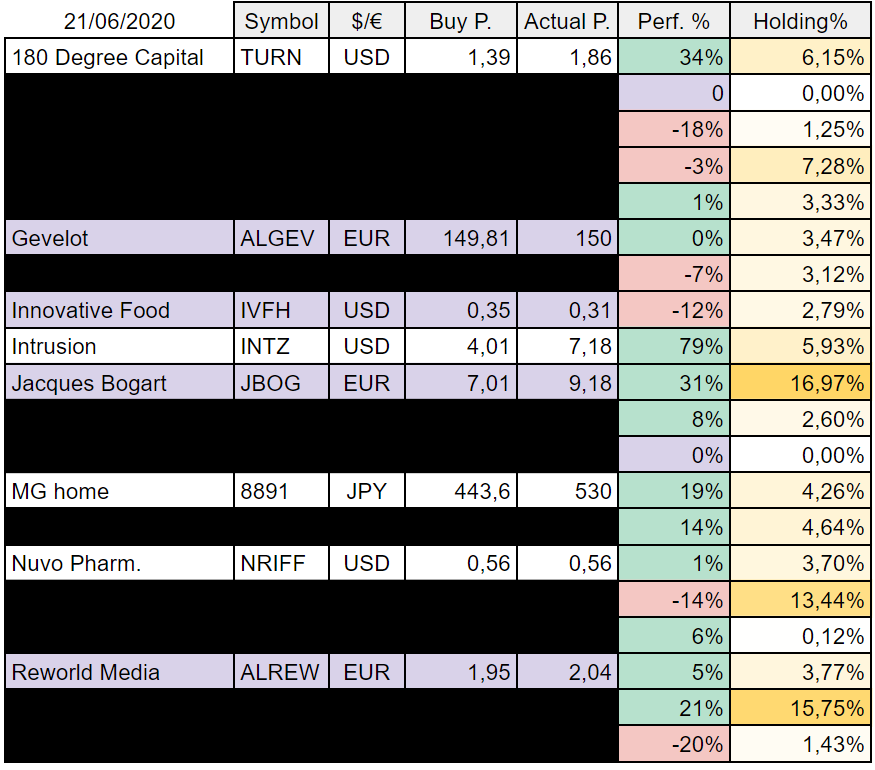

Bonus : Current Portfolio