MG Home, is a Japan based company selling and leasing real estate. The company is a microcap stock quoted on NSE-2 (Nagoya stock Exchange) / TSE-2 (Tokyo Stock Exchange) and domiciled at Nagoya.

The company build, sell, lease and manage properties located around Nagoya at center of Japan. Nagoya the fourth biggest Japan city, his Metropolitan region is the third bigger and count 10.2 Millions inhabitant. This area locate headquarters of Toyota, Brother (the printer) and many automotive/ceramic companies.

41% of MG Home shares are owned by VT Holdings, an USD 300M market cap company operating in vehicle area (mainly selling Honda cars and repairing cars) listed on NSE-1 and TSE-1. I checked this company, I don’t think it’s worth to own MG shares through VT Holdings. Car companies will be severly impacted by COVID and we don’t have enough discount on asset there (P/B = 0.89).

On a valuation view MG home is incredibly cheap (using JPY432 per share) :

- Market Cap (in USD) = 11.6 Million

- Price to Book = 0.34

- PER = 1.3

- Price to Sales = 0.1

- Price to cashflow : 1.24

- EV/EBITDA = 2.9

- ROE = 23%

- Debt to Equity : 77%

Debt to equity ratio should be monitored over long term.

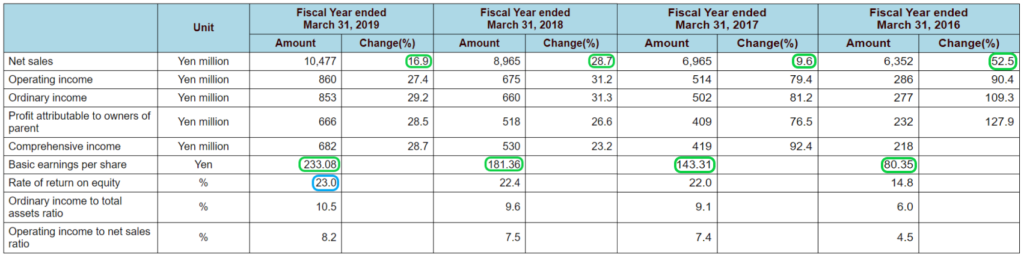

During last four years, sales and net income increased slightly :

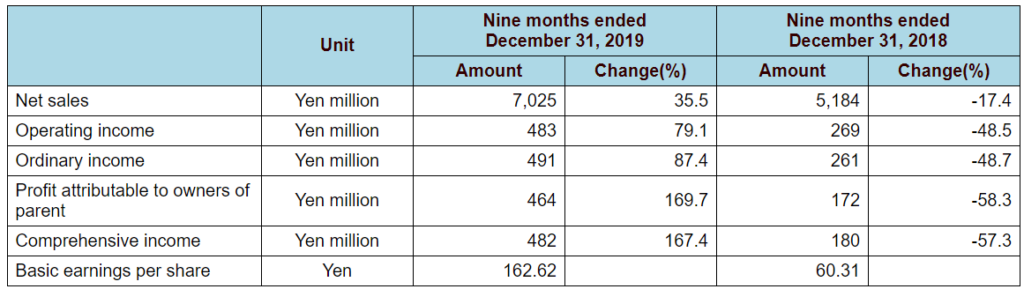

This year we have (before COVID-19 crisis) :

-> Company still growing, financial statements of year 2020 will come on May.

Number of shares is stable since 2009 (with a stock split in 2015). A good point cause the company didn’t diluted his share but a bad point cause zero buyback were done. Some consolation can be found with a small dividend (JPY21) paid every year slowly increasing year after year.

Some graph chart to complete analysis :

I’m not a big fan of chart analysis but we can see a big drop during COVID crisis and an upward average trend since 2019.

COVID crisis may impact the business but lockdown wasn’t long in Japan and population is used to wear mask. It should limit the spread of infection. In Europe lockdown suscited the envy of population to move on countryside, a good point for MG Home if same thing happen in Japan.

My Objective = 1270/share (100% of Book Value per share). At this price if growth continue it still pretty cheap.

Disclosure : Long 2.6k shares, purchase price JPY443

Images Credits : MG home website, kaijinet.com, google.com.